NO. 15: LESSON NO. 46: THE CHALLENGES OF MULTIPLE FOUNDERS/G1’s

An audio book version of Building With the End in Mind will be available shortly to complement the current eBook/Kindle, paperback and hardbound versions. To assist listeners as they enjoy the audio book, I am adding this particular Lesson in its entirety in order to capture the details of an embedded Excel table with full context so it can serve as a clear reference while listening (i.e., it’s hard to read a table in an audiobook!). Again, if you have questions that arise after listening to the audio book and/or this Lesson, don’t hesitate to submit them under the “Ask Questions” tab.

Thanks for reading (and listening!),

David Sr.

LESSON NO. 46: The Challenges of Multiple Founders/G1s

It is not unusual for two or three owners of similar age to start a new business together. But in the context of a Succession Plan and/or a Continuity Plan, age in this context can pose a real challenge. Two or three founding owners who are all in their late 50s, all G1s, provide a lot of experience and financial strength, in most cases, but when it comes to being buyers, time is not on their side. Effectively, without next generation owners in the mix, such a Business has few, willing and able internal buyers at the G1 level. The ages of the owners are one factor in this discussion, with the amount Equity owned by each, the value per share, and their retirement horizons being the other key factors.

Let’s set the table and deal with this situation. Three owners, G1(A) who is 56 years old, G1(B) who is 55 years old, and G1(C) who is 53 years old. Ownership is held equally. The Business has done well and its value is approximately $6.0 million. The youngest of the G1 owners anticipates retiring earlier than his colleagues, hopefully around age 62, but none of the owners want to work much past 65. This group has struggled to assemble and retain sufficient next generation/G2 talent and is not confident in a Succession Planning solution. As such, all three are willing to consider a sale to a third-party or outside buyer under the right circumstances when the time comes. There are two potential G3 candidates who show a lot of promise, though both are in their late 20s and neither have run a business before, nor even owned their own Book.

The founders of a Business, if documented properly, tend to be each other’s continuity partners through a formal, Buy-Sell Agreement. If something happens to one of the owners, the remaining owner(s) are usually obligated to buy out and pay value to the exiting owner or his/her estate. Depending on the value of the Business and keeping in mind that most conventional bank loans carry five to ten-year amortization or repayment schedules, having one of two or three owners leave when the group is in their late 50s can be problematic, and expensive. Sometimes, there isn’t much choice, or warning. Obviously, having life insurance in place as a possible funding mechanism is wise. The Business, as we’ve previously considered, can be the buyer and the borrower if necessary, redeeming the exiting owner’s shares, but this serves to place any debt on the Business’s Balance Sheet, decreasing its value until the debt is extinguished. Redemption also creates a lot of Phantom Income to each of the remaining shareholders through a Tax-Conduit on a pro rata basis.

From a Succession Planning perspective, the modeling process needs to take into account the anticipated and, as specifically as possible, the retirement timeframes for the three G1 owners. One possibility is that the remaining G1 owners want to work well into their 70s; another possibility is that they bring in at least one G2 who can effectively buy-in, worst case through a Continuity Plan provision, if need be, or more directly; or they can sell the entire Business together via an Exit Plan on a collective timetable that works for all. If a strategic buyer can be found, the Exit Plan might be fashioned as more of a merger, with all three G1’s then continuing to work for the new and larger buyer/company.

Selling a Business of this size to the two younger G3’s is not practical. At this juncture, there is likely time for only two tranches and that is if the first Tranche (T1) occurs fairly soon. T1 transactions rarely exceed $500,000 in value, per sale/purchase, because the younger owners usually are not comfortable with a larger amount of debt and debt service on an intangible Business.

It is noteworthy that, in a previous Lesson, we recommended that regular shareholder and Directors meetings take place on a quarterly basis. The issue in this Lesson is not at all unusual, and it may have no resolution in terms of a Succession Plan, but how it all unfolds should never be a surprise. This issue is one that should be discussed regularly in those meetings starting ten years earlier. Maybe in that time a solution can be settled on and implemented, and maybe not. Maybe expectations and time frames for each owner need to be adjusted for the good of all involved. Maybe selling to a third party is the best answer; time will tell. But just letting time pass without any plan and seeing what happens is not a good strategy either.

Another interesting possibility is to attempt to merge a similar but smaller and younger group of owners into this larger Business and jump-start the Succession Plan with two or more G2’s who have ownership experience and who will become immediate owners upon completing the merger. This coming together may be a statutory merger when the two entities are corporations, or it may be an asset contribution when the continuing entity is an LLC taxed as a partnership. Those are details best left to an M&A attorney once a strong mutual interest in finding a solution exists.

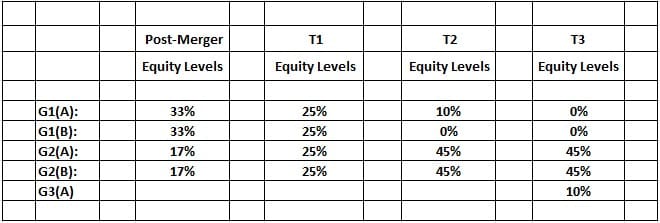

For example, as G2(A) and G2(B), equal partners, merge their $2.0M valued Business into G1s’ $6.0M valued Business, the new, post-merger ownership structure might look like this on a Tranche-by-Tranche basis:

Within a few years after the merger, T1 should occur, with T2 about 5 to 6 years later. G1(A) and G1(B) can use a residual equity strategy as another possibility. G2(A) and G2(B) will not need a long-term bank loan to buy-in during T1, T2 and T3 because they have equity ownership via the merger with no debt to service and this will allow them to use up to 20.0% of the profit dollars, each, to pay for a 7.5% acquired Equity Interest (T1), and then 30.0% of the profit dollars, each, to pay for a 10.0% acquired Equity Interest (T2), and so on. This provides an acceleration effect using the Profit-Based Note theory covered previously and explained briefly in the Glossary.

On day one, post-consolidation, the Business is worth at least $8.0M and with a good, diverse team of owners in place, powered by strong growth, the Residual Equity interests of 10% each for G1(A) and G1(B) could be worth $1.5 million to $2.0 million over time, buying some patience in the planning process.

Obviously, a restructuring like this changes everything, for everyone. These aren’t easy to do, and compatible, long-term partners are not easy to find, but they offer possibilities and opportunities that neither of the smaller Businesses may have on their own. It just might be worth striving for and hiring a headhunter to compile a short list of prospects and getting to work on it.

The other obvious solution is to sell the Business as a group of three G1s to a larger, third-party buyer or consolidator and build employment agreements into the transaction for the parties who aren’t quite ready to fully retire yet. Practically, small businesses of this size have a tough time attracting private equity as an alternative. But even a non-sustainable Business in its own right, that is growing and profitable, will have suitors. Just remember to sell on the way up, as the Business is growing, and not on the way down; best to sell too soon!